House Insurance Flood Zone 3

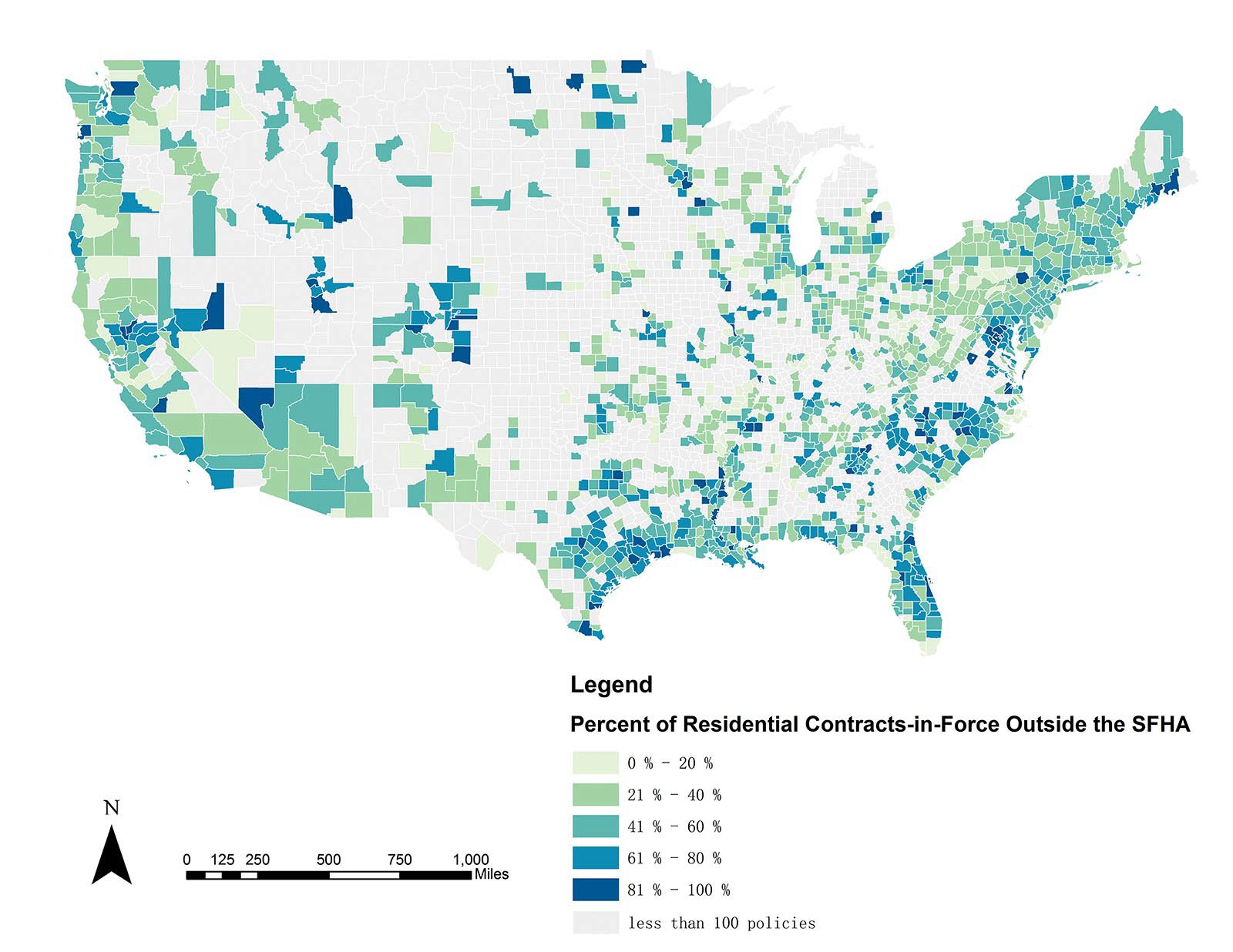

Sometimes only a portion of a property is located in a flood zone. More than 20 percent of flood claims come from properties outside the high-risk flood zone.

Elevation Certificates Vbgov Com City Of Virginia Beach

Your standard homeowners policy wont provide flood insurance the spokesperson adds.

House insurance flood zone 3. Get Your FEMA Map- Click Here. You might be required to get flood insurance. Before we offer I did my history and it is indeed in the highest category of flood risk.

Coverage is available in a separate policy from the National Flood Insurance Program and a few private insurers that partner with the NFIP. Raising your house 3-4 ft. Read more What is Flood Re and how does it affect home insurance.

If you rent you can buy up to 100000 in coverage for your belongings. What to do if your house floods. However if the structures included in the appraised value are not in the flood zone flood insurance is typically not required.

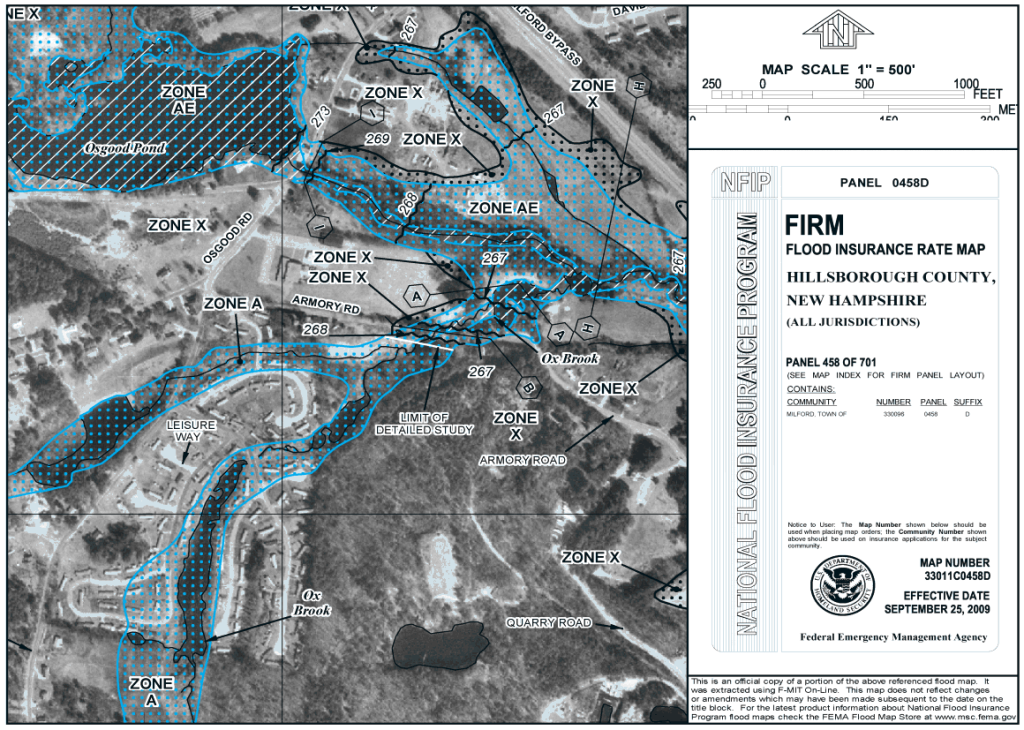

The National Flood Insurance Program. Flood Insurance Rate Map FIRM Flood Risk Mapping is an important part of the National Flood Insurance Program as it is the basis of the NFIP regulations and flood insurance requirements. But premiums could run much higher depending on your risk zone.

Phoned EA who say that the reason we are zone 3 is because of the brook 150m not the one in the back yard. If you raise your house a full 6 ft you have the potential to save up to 2000 in 4-5 years just on insurance premiums alone. For non-residential property you can buy up to 500000 of coverage for the building and contents.

Those who live in high-risk flood zones designated with the letters A or V on a flood insurance rate map or FIRM are usually required by their. The zones only refer to areas at risk of flooding from rivers or the sea although not all rivers have been included in calculating the zones. In the most extreme cases a home in a V zone can cost 100 or even 200 what it costs to insure a home in a B C or X zone.

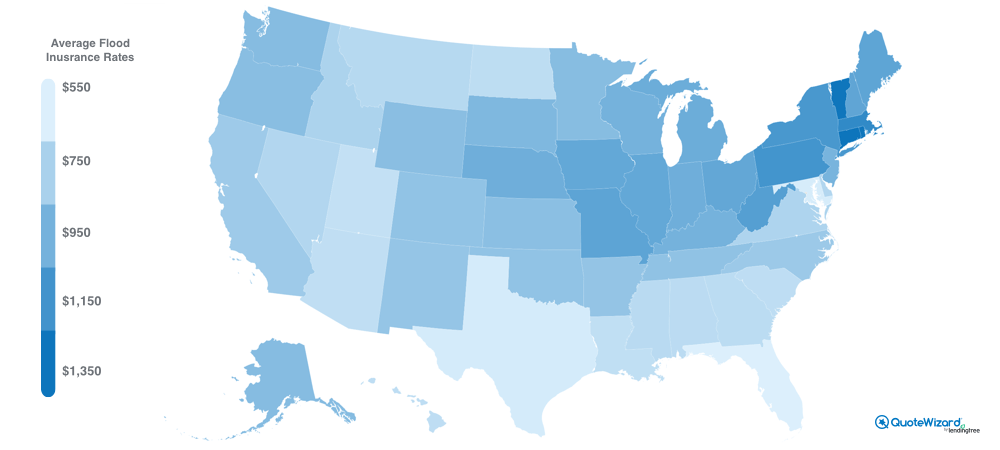

The estate agent as well as the vendors were quick to point. We are moving and have found a house we really like it is only 30 feet from a small river though. Annual flood insurance rates through the NFIP vary based on your flood zone and the structure of your house.

Flood insurance policies also reimburses you for the work that you and other family members did to sandbag your homes move furniture and remove debris. A standard NFIP flood policy offers 250000 in coverage for the structure and 100000 in contents and flood-relation claims filed through the NFIP pay out an average of 52000. Most Ohio communities participate in the National Flood Insurance Program.

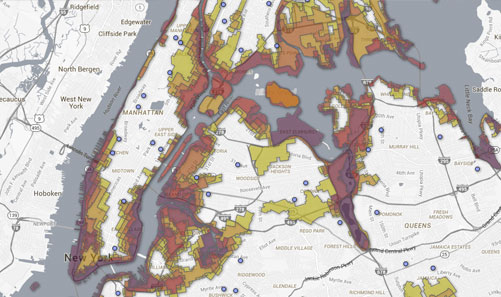

Everyone lives in an area with some flood riskits just a question of whether you live in a high-risk low-risk or moderate-risk flood area. Flood insurance comes with separate deductibles for the. Flood zones are indicated in a communitys flood map.

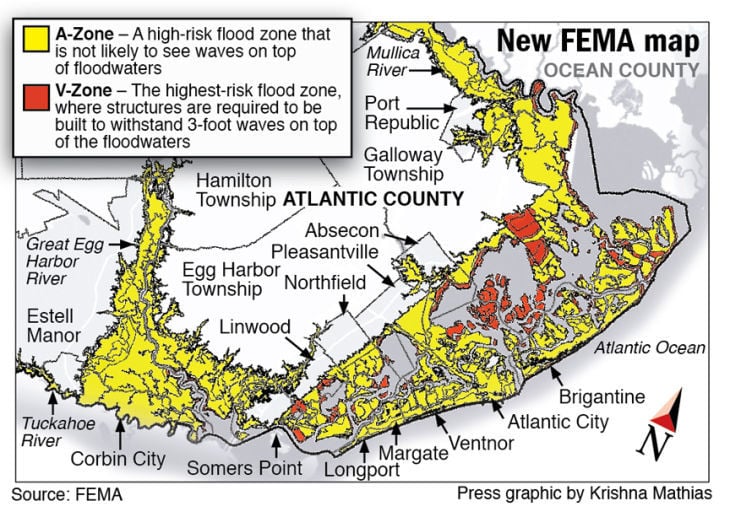

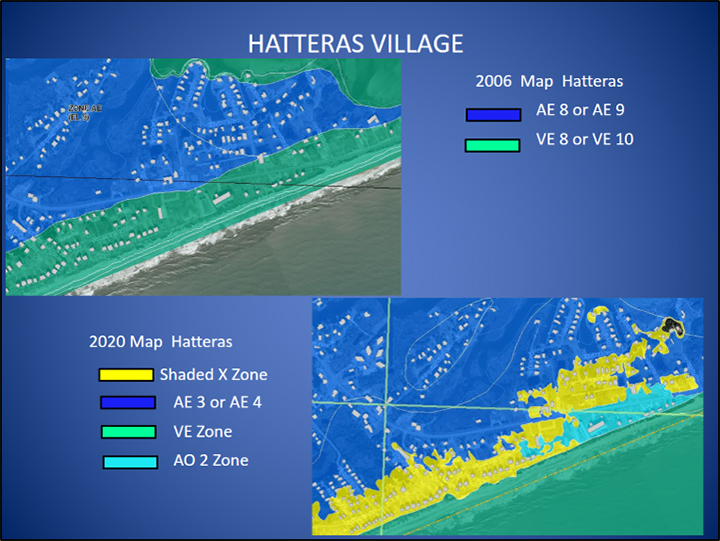

Areas in flood zone 1 are least likely to experience flooding during the year whereas those in flood zone 3 are most likely to experience flooding during the year. If a property covers two or more flood zones the insurer will rate the premiums based on the most hazardous zone. FEMA flood zones are flood risk areas identified on the Flood Insurance Rate Map.

If you live outside a high-risk zone or if you no longer have a mortgage. Is anyone making insurance more affordable for flood-risk homes. On further research it appears that flood defences are in place and the report does say that there is no record of any flooding to the property or adjoining property and no record of previous insurance claims due to flooding.

Flood insurance costs on average 700 per year. It doesnt change the way you buy your insurance though you can still buy your home insurance in the usual way by starting a quote with us. If a property is mapped into a high-risk area shown as a zone labeled with letters starting with A or V and the owner has a mortgage through a federally regulated or insured lender flood insurance will be required when the FIRM becomes effective.

Would you buy a house in flood zone 3. While coverage for low-risk properties can be as little as 100 a year high-risk coastal properties can cost upwards of 10000 a year to insure. Each flood zone describes the flood risk for a particular area and those flood zones are used to determine insurance requirements and costs.

There are three different flood zones. When this is the case it is common for the lenders flood certification to require flood insurance. Homeowners and renters insurance do not typically cover flood damage.

The NFIP lets you insure your house for up to 250000 and your personal property contents for up to 100000. Usually BFEs derived from detailed hydraulic analysis are shown at select intervals within this zone. Zone AE and A1-A30 corresponds to 100-year or 1 annual chance floodplain that is determined in the Flood Insurance Study by detailed methods.

The type of flood zone you live in has a huge effect on the price of your flood insurance. Lenders do have the option to make the purchase of flood insurance a condition for. Flood zone 1 includes areas that have less than 01 chance of flooding in any year.

Can knock as much as 60 off of your flood insurance premiums. 1 in 30 chance of flooding 34. At least 35 million homes in England are at risk of flooding with one in 12 of these categorised as high risk.

Posted 3rd Feb 2017. After the 2015-2016 floods which were the worst on record the Flood Re scheme was set up to help people in flood-risk areas find affordable insurance. However insurance premiums vary by state and flood zone meaning your monthly payments would likely be higher if youre living in a high-risk area Zones A or V.

Floods can happen anywhere. You may be required to have flood insurance. Flood Re aims to give homeowners a wider range of home insurance options at a more affordable price.

If you live in certain flood zones your mortgage company may require that you purchase a flood insurance policy. However raising your house a full 5-6 ft. Above the flood zone can save you 20-30 on your insurance premium.

Flood Insurance In New Jersey Valuepenguin

Understanding Fema Flood Maps And Limitations First Street Foundation

Homeowners Insurance Vs Hurricane Insurance Vs Flood Insurance What S The Difference

First Major Real Estate Website Adds Flood Risk To Listings Npr

Understanding Fema Flood Maps And Limitations First Street Foundation

Fema Updates Flood Maps Requirements Aws Insurance Company

The 3 Maps That Explain Residential Flood Insurance Purchases Risk Management And Decision Processes Center

How Much Does Flood Insurance Cost 2021 Rates By State And Zone

Average Cost Of Flood Insurance 2021 Valuepenguin

Fema Flood Map Updates North Port Fl

Flood Zone Rate Maps Explained

Flood Zones Insurance Ri Shoreline Change Special Area Management Plan

Fema Shrinks Flood Zones On New Maps A Relief To Homeowners Local News Pressofatlanticcity Com

New Dare Flood Maps Misrepresent Risk Coastal Review

Mission First Street Foundation

Understanding Fema Flood Maps And Limitations First Street Foundation

Why Your Virginia Flood Zone Map Is Missing The Mark How To Fix It

Post a Comment for "House Insurance Flood Zone 3"